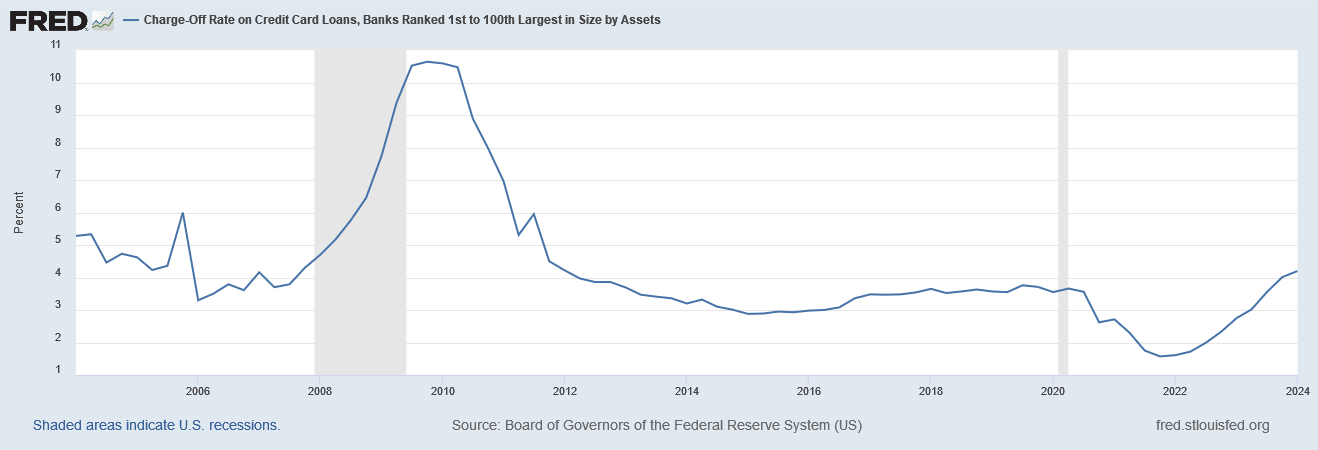

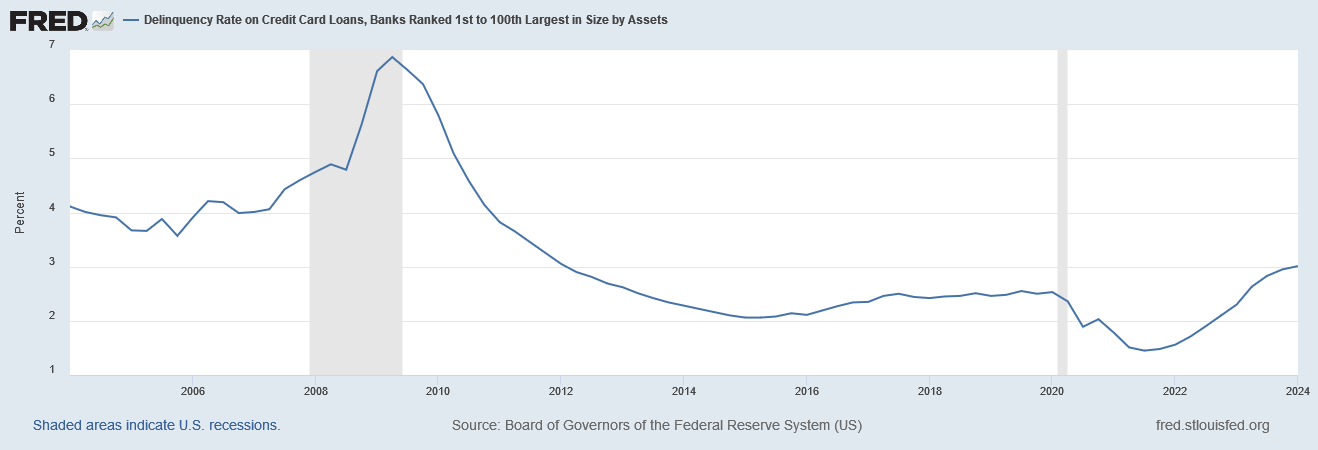

Another 12-Year High for Credit Card Charge-Offs and Delinquencies

Federal Reserve Releases Q1 Data

By Joel Rosenthal, ProVest Vice President, Head of Credit Collections Business Development & Client Relations

Credit card charge-offs and credit card loan delinquencies continue to be at a 12-year high, according to the Federal Reserve’s first-quarter report. There are clues in the FED’s quarterly data indicating future account volume.

First quarter 2024 data reveals that credit card charge-offs increased from 4.01% to 4.20%. The recent quarter’s curve may be flattening out, but it is still growing at a rate that does not appear to be topping out as of yet.

Credit card loan delinquencies, an early indicator of charge-offs, increased from 2.95% to 3.01%. For the second consecutive quarter, the curve is flattening, which suggests that we are approaching a period of more gradual increases or possibly peaking.

In ProVest’s experience, there is generally a 9-12-month lag from when the charge-offs occur before our litigation clients see the volume. Considering that both charge-offs and delinquencies have continued to increase, it suggests a surging volume well into 2025. It’s important to ensure you have the capacity to handle and process the ever-increasing volume.

The Federal Reserve’s charts for the data referenced follow and are linked.