Q4 Credit Card Charge-Off Rates and Delinquencies Both Decline Slightly

By Joel Rosenthal, ProVest Vice President, Head of Credit Collections Business Development & Client Relations

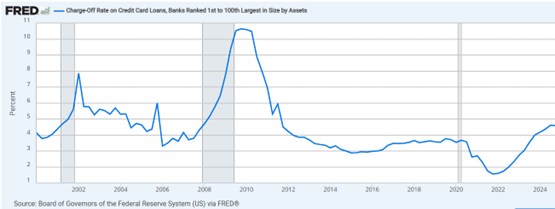

Recent data reveals a slight decrease in credit card charge-off rates, marking the first decline in the post-COVID era. The charge-off rate has dipped from 4.61% to 4.58%. While this decrease may seem marginal, it signifies a potential improvement in consumer credit health.

Due to the typical 9-12 month lag between charge-offs and legal placements, the volume of accounts entering collections is expected to continue increasing year over year through the end of 2025. However, the outlook for 2026 remains uncertain, depending on whether charge-off rates continue to decrease or plateau.

Delinquency rates decreased from 3.08% to 2.97%, providing a 6-9 month early indicator of the charge-off data. Notably, the third quarter results were revised downward, making the fourth quarter of 2024 the second consecutive quarterly decline in delinquencies since the COVID-19 pandemic began.

These consecutive declines in both charge-offs and delinquencies suggest a potential stabilization in consumer credit health, though experts are not prepared to declare a definitive turnaround given the ongoing economic uncertainties and the record-high credit card debt levels reported by the Federal Reserve Bank of New York.

The Federal Reserve’s charts for the data referenced follow and are linked.