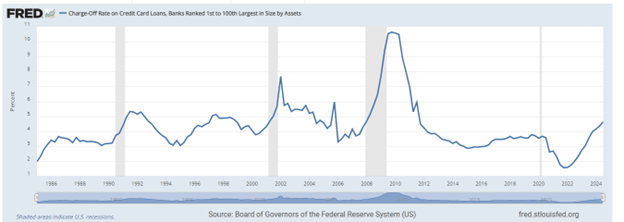

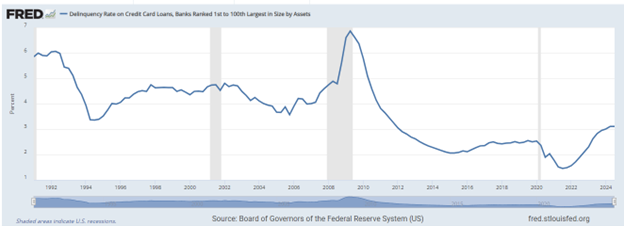

Credit Card Charge-Offs and Delinquencies Hit 13-Year High, Are They Peaking?

By Joel Rosenthal, ProVest Vice President, Head of Credit Collections Business Development & Client Relations

Credit card charge-offs and credit card loan delinquencies hit a 13-year high, according to the Federal Reserve’s third-quarter report.

Third-quarter 2024 data reveals that credit card charge-offs increased to 4.65%, up from 4.36% in the previous quarter, marking the highest level since the third quarter of 2011. Charge-offs are continuing to grow at a fairly steep slope. With a 9–12-month lag time to legal placements, the volume should continue to increase well into 2025.

Credit card loan delinquencies, an early indicator of future charge-offs, have held steady at 3.11%. While this represents a plateau, it reached a 13-year high. The stability of this rate raises questions about whether it signifies a temporary pause or if delinquencies have peaked and may begin to decline. Delinquencies are particularly significant as they often precede charge-offs by six to nine months, providing insight into potential future trends in credit card defaults.

Wilbert van der Klaauw, economic research advisor at the New York Fed, highlighted the broader implications of these trends: "Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels. This signals increased financial stress, especially among younger and lower-income households."

The Federal Reserve’s charts for the data referenced follow and are linked.