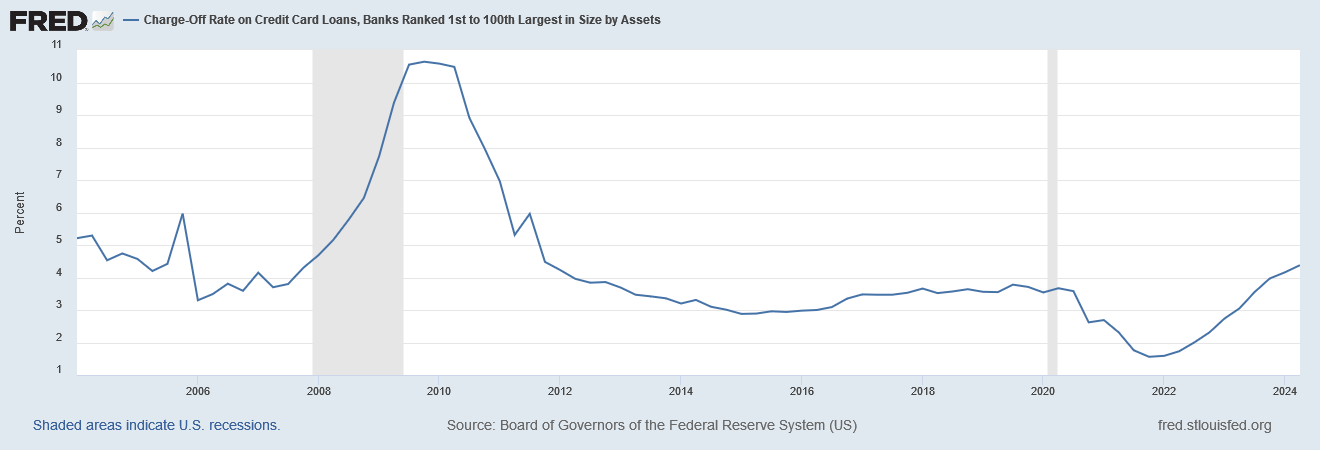

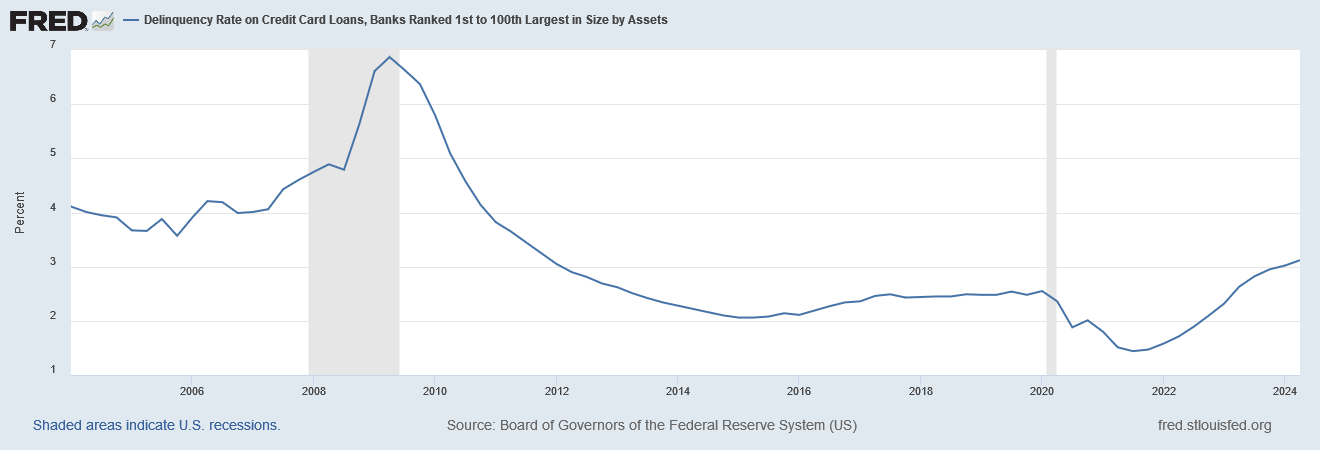

Credit Card Charge-Offs and Delinquencies Increased to More Than a 12-year High

According to Federal Reserve’s Q2 Data

By Joel Rosenthal, ProVest Vice President, Head of Credit Collections Business Development & Client Relations

Credit card charge-offs and credit card loan delinquencies continue to be at a more than 12-year high, according to the Federal Reserve’s second-quarter report.

Second quarter 2024 data reveals that credit card charge-offs increased from 4.16% to 4.38%, a 12.5-year high not seen since Q4 2011. Charge-offs are continuing to increase at a fairly steep slope. With 9–12-month lag time to placements, the volume should continue to increase through at least mid-2025.

Credit card loan delinquencies, a six-to-nine-month early indicator of the charge-off rate, increased from 3.02% to 3.11%, also a 12.5-year high. After the Q1 data release, it appeared that delinquencies might be peaking; however, last quarter’s data shows a possible new increase in velocity.

It is important to note the context of the increasing delinquency rates. Credit card lending and delinquencies both increased year over year: YOY delinquencies increased by about 0.5% from 2.63% to 3.11%, credit card lending increased by 10.8% to $1.142 trillion from $1.031 trillion. A larger lending pool AND a higher percentage of delinquencies mean firms can reasonably anticipate a high workflow level into mid-2025.

The Federal Reserve’s charts for the data referenced follow and are linked.